A Bottomless Fall: How El-sisi Perpetually Reproduces Egypt's Economic Crisis

In a leaked video from October 2013, then-Defense Minister Abdel Fattah el-Sisi, before deposing President Mohamed Morsi in July of that year, is seen in a meeting with military officers, seemingly asserting his influence as a strongman within the armed forces.

Sisi says in the leaked footage: “If they put me in charge, I’ll make the person talking on the phone pay, and the one listening pay.” He elaborates on his rationale, adding: “I don’t recognize anything as free. Egyptians must get used to paying for services.”

This vision partially materialized after Sisi assumed the presidency. For the first time since telecommunications were introduced in Egypt, users faced an indirect tax in the form of reduced real value of recharge cards and mobile plans, receiving 36% less credit for the same price. This came alongside higher taxes and newly imposed fees on telecommunications and internet services, compounded by a continuous rise in service prices.

One clear takeaway from this reality is that President Sisi entered office with a pre-existing and comprehensive vision for handling many files—even the seemingly minor ones. He has repeatedly emphasized this over the years, including in a 2016 speech to critics in which he asserted loudly and sternly: “I know Egypt and how to cure it, just as clearly as I see you in front of me.”

This vision quickly became the foundation of the current regime and the cornerstone of Egypt’s economic policies for over a decade. Understanding the hidden dimensions of Egypt’s current economic crisis requires examining how Sisi governs the state’s economy—his views, approach to domestic and international stakeholders, and the complexities therein.

Some interpret the regime’s public policies as stemming from “failure” or “poor planning.” While that may be partly true, this explanation alone obscures the bigger picture.

There is evidence that many state policies and economic decisions were not haphazard but deliberate and calculated, with outcomes that align with the regime’s intentions, goals, and alliances.

Before becoming president in 2014, Sisi made grand projects the hallmark of his campaign, aiming to reshape the state according to his vision. He wanted to dazzle the public with massive construction initiatives that would set him apart from past presidents and position him as bolder and more accomplished.

This warrants a closer look at who benefits from these projects, where the state’s resources are directed, and why the regime has taken a path that has led to inflation, reduced purchasing power, and erosion of people’s savings and wealth.

In 2023, Sisi claimed Egypt spent approximately 10 trillion Egyptian pounds (about $300 billion) on infrastructure. It’s unclear if this includes new cities like the $58 billion New Administrative Capital and the $8.2 billion New Suez Canal, along with 30 other cities built in Egypt’s deserts.

These projects featured economic actors involved according to their relationship with the regime’s apex. The military secured the lion’s share, joined by considerable Gulf investments, private sector contributions, and IMF support, which together created the policy framework of Egypt’s economy.

Sisi and the Military: Who Governs Whom?

From day one, the regime has pursued massive spending on infrastructure, new cities, and real estate, irrespective of consequences. These sectors offer generous profits and are not technically complex.

With no transparency or public disclosure, projects can be awarded to any entity, which in turn subcontracts the actual work. The military was the regime’s chosen executor. But to understand Sisi’s relationship with the military, one must grasp the military’s position in governance, which has two key dimensions:

First: The military is part of the political system and works to preserve it, as do other key players in the ruling coalition—president, army, security, judiciary, and top bureaucracy. This requires prioritizing power networks, both within the military and across other ruling circles.

What cements the bond between Sisi and the military, through which he rose to power, is their shared view of political legitimacy and strategic doctrine. Both aim to preserve the state’s form and prevent infiltration by rival political currents, especially the Muslim Brotherhood, to avoid Egypt undergoing a similar experience to Islamist-led countries.

Yet, while Sisi rules in the army’s name, which claims historic entitlement to power (snatched from it by corrupt businessmen during Mubarak’s era), and while the military is the source of legitimacy, the army itself does not rule directly—a deceptive situation for many observers.

The military is not a ruling institution like Saudi Arabia’s royal family or Egypt’s defunct National Democratic Party. It is a platform for power, and although it serves as the ultimate authority during crises, in normal times it falls under presidential influence.

Second: The military is Sisi’s main tool to accomplish tasks, much like the Arab Contractors company under Sadat. It seeks a place in the economy to secure lucrative government contracts—Egypt’s primary investment source—over competitors, ensuring profit.

Today, the military controls a significant portion of public works, infrastructure, housing, mining, land use, media firms, and hotels. What differentiates it from the Arab Contractors—besides scale—is its political clout, which burdens it with responsibilities such as maintaining regime stability, offering goods slightly cheaper than the private sector to middle and lower classes, and shaping public policy.

While not wholly responsible for crafting Sisi’s economic strategy, the military co-authors it and plays a role in manufacturing, telecom, digital transformation, rural development, and executing state-prioritized projects.

This stems from Sisi’s lack of a civilian political base, making the military an indispensable political pillar. Distrustful of forming a ruling party—scarred by the National Democratic Party’s legacy—and with existing parties mere PR arms run by state security, Sisi rewards the military’s critical support with lucrative ventures.

Sisi also believes civilians are inefficient and corrupt, both in the state apparatus and private sector. He sees the military as more competent, honest, and adept at bypassing bureaucratic red tape, delivering results faster.

This belief is evident in a 2014 interview when he said: “May Egypt one day resemble the army.” Similarly, in a 2017 youth conference in Ismailia, he stated: “The military plays a parallel developmental role identical to the state.” On another occasion, commemorating the 10th of Ramadan War, he added: “Post-2011, only the army’s organizational, administrative, and economic capabilities could be relied on.”

At the opening of the military’s fish farming project in Kafr El-Sheikh (November 2017), Sisi said: “We’re executing the project completely. That’s the state. The military represents the state.”

Sisi relies entirely on the military, sidelining other institutions except for those handpicked by the army, like the Urban Development Authority—also led by former officers.

This helped the military secure a central role in Egypt’s economy, managing over a quarter of public spending on infrastructure, housing, and even ministerial public works. Specialized military units now help shape national policy.

Military officers embedded in civil institutions reproduce Egypt’s long-standing issues: top-down economic planning, investment decisions divorced from market needs or state capabilities, and rampant corruption.

The ascent of Engineering Corps commander General Kamel al-Wazir—now Deputy Prime Minister and Minister of Transport and Industry—illustrates this mindset shared by Sisi and the army about military competence versus civilian inefficiency.

Known among contractors for his forceful management style, al-Wazir bulldozes bureaucracy, pressuring engineers and workers to finish projects ahead of schedule—a trait admired by Sisi, eager for rapid, media-friendly accomplishments.

These projects allow both the presidency and military to boast in the media, while deliberately overlooking the enormous financial strain they place on limited resources and the opportunity cost of not investing in productive sectors.

All this hampers economic growth and public service development. While infrastructure projects employ hundreds of thousands, many more suffer as the private sector contracts, unable to compete with military-run firms that dominate markets and financing.

Sisi and the military don’t see this, because they share a view of the economy not as an interconnected system but as a series of standalone projects.

This simplistic vision prevents policymakers from accurately assessing project costs or returns—financially or in terms of alternative investments that could yield greater value instead of sinking capital into cement.

Sisi and the Contractors: An Alternative to a Popular Base

Egypt’s infrastructure projects have stretched into remote deserts, building new cities, and reached all governorates and most villages through the “Decent Life” initiative.

In a system reliant on infrastructure investment, public contracts are used to fortify regime foundations. This explains the insistence on a path that burdens the state budget but successfully created a supportive social segment. Sisi began with sweeping public support, which gradually waned.

The military grabs wealth-generating contracts and distributes them to selected loyalists whose fortunes are tied to the regime. These contractors form a pro-regime social class—until some withdraw support when denied payments.

This helps explain the rise of figures like Ibrahim al-Arjani, whose company collected money from Palestinians at the Rafah crossing. Leveraging his military ties, he won major contracts in Sinai infrastructure, expanding his empire in exchange for the loyalty of his tribe—the Tarabin, Sinai’s largest—along with other regional tribes.

By contrast, major private firms with technical expertise, like Orascom Construction or Elsewedy Electric, didn’t need to express political loyalty due to their indispensable role. They received their share of contracts, benefiting from public wealth.

Overall, whether small contractors-turned-tycoons or large private firms, working on state projects shaped a social layer that, if not overtly pro-regime, was at least non-confrontational. This includes artisans and tradespeople regularly involved in state projects in their provinces or new cities.

Their employers—the subcontractors—depend on securing state contracts and favor, creating a clientelist political relationship with the regime. This mutual interest ensures the construction frenzy continues indefinitely.

Over the years, even amid economic crisis, ballooning deficits, and a foreign currency crunch worsened by these projects, the state, including Sisi, defended its construction-focused policy. Their rationale? These projects employ millions and involve thousands of private companies, making them indispensable.

In May 2024, Sisi said: “I consider it a profit when an idle man finds work. A project may not yield much financial gain, but it employs many. That’s income in my book—100,000 workers and their families benefiting. That’s financial gain.”

Yet, there’s ample evidence the goal isn’t just Keynesian-style job creation but building an expansive loyalty network across Egypt. These people’s livelihoods depend on the regime and its policies, tying their fortunes to its survival.

Unlike past regimes, the current one lacks a traditional popular base. Nasser had support from the poor and middle classes due to his socialist leanings. Sadat’s base was traders and the wealthy. When that wasn’t enough, he unleashed the Islamists. Mubarak had the National Democratic Party and civil servants.

Today, liberal claim that the military crowds out the private sector overlook how major state projects foster mutually beneficial ties with a segment of private firms, especially SMEs enjoying military perks.

These companies scramble to curry favor with the military to secure subcontracting deals—translating into political support, especially during elections, or passive backing via silence.

This dynamic creates a form of negative endorsement: silence in place of opposition. And across sectors, it fosters a deep-seated dependency on the regime’s continuation—not due to ideological support but economic necessity.

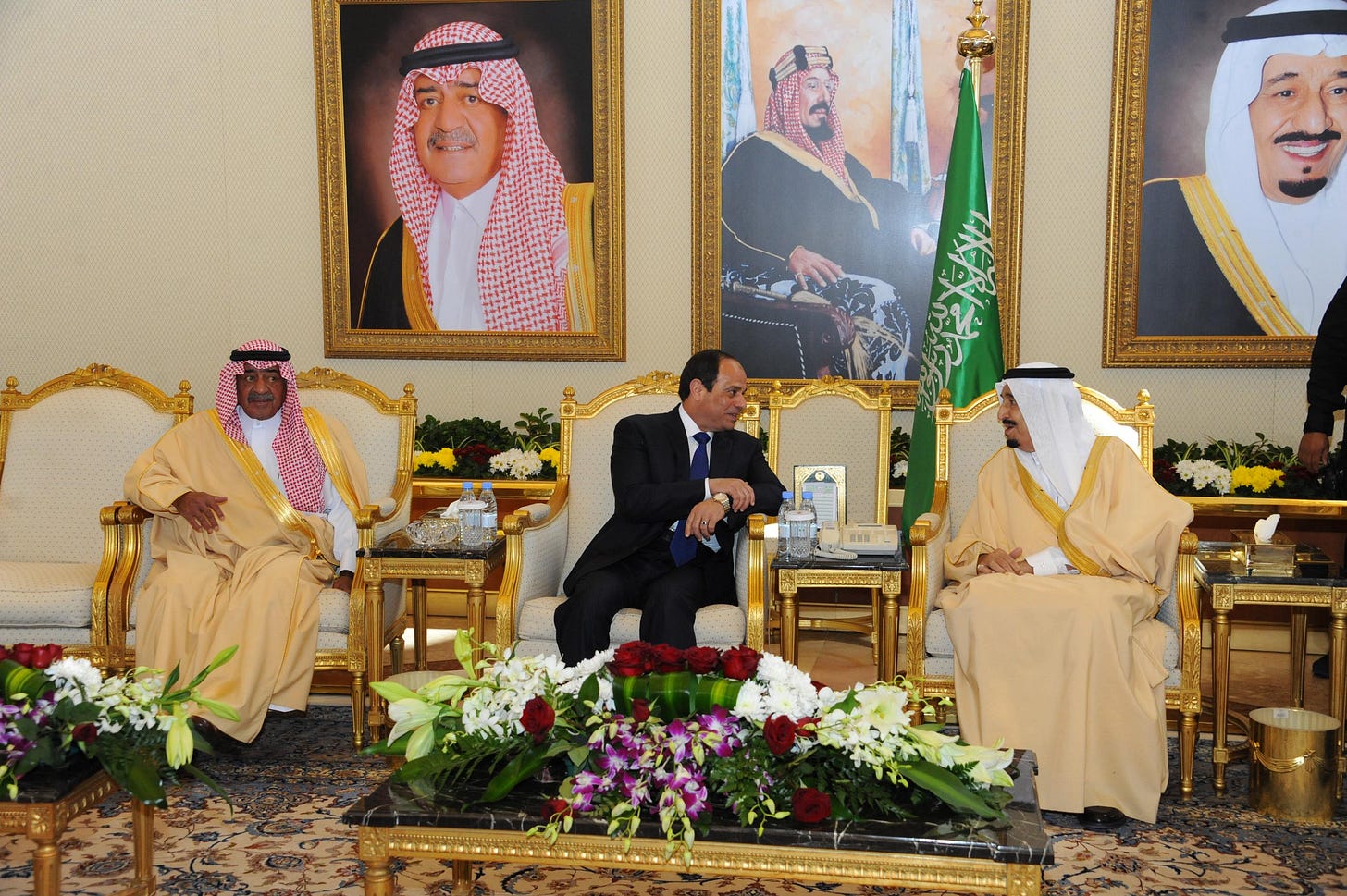

Sisi and the Gulf States: From Grants to Asset Sales

The Gulf states played a pivotal role in toppling former President Mohamed Morsi and facilitating the rise of the military establishment under General Abdel Fattah el-Sisi.

At the start of his rule, Saudi Arabia and the United Arab Emirates wasted no time offering support to the new regime—through fuel shipments, in-kind assistance, and direct financial aid. Saudi Arabia committed to securing Egypt’s oil needs for five years and, along with the UAE, provided infrastructure support and cash grants totaling an estimated $100 billion.

For over a decade, President Sisi often expressed gratitude for this Gulf aid, emphasizing its importance in resolving major crises, particularly energy shortages.

In one of his recent speeches, Sisi said: “Without Gulf support, this country would never have been able to overcome what it went through. It wouldn’t have even been able to stand on its feet.”

Indeed, the generous aid helped stabilize the new regime, solving fuel and electricity shortages and allowing the government to project strength, all while containing political unrest and street protests.

But this generosity didn’t last. Once the Muslim Brotherhood threat receded, the Gulf states saw no reason to continue handing out unconditional aid—especially as they faced economic challenges of their own due to falling oil prices.

When the free-flowing cash stopped, and with Sisi’s mega-project ambitions in full swing, Egypt had to seek alternative funding sources. That led to its first loan agreement with the International Monetary Fund (IMF) in 2016, securing a $12 billion facility.

To bring the Gulf money back, Sisi had to offer something in return. He understood the value of his position and the country’s strategic assets—knowing full well that fresh funds would only come through concessions.

The Gulf states, in turn, expected favorable deals in exchange for liquidity. They used Egypt’s economic crisis and urgent need for capital to expand their influence and assert themselves politically and economically.

Thus, the Gulf aid became a tool for reshaping bilateral relations and securing leverage in line with their geopolitical ambitions.

The first major deal involved the 2017 agreement granting Saudi Arabia sovereignty over the strategic islands of Tiran and Sanafir—located at the southern entrance to the Gulf of Aqaba. The Egyptian regime weathered internal pressure, suppressed protests, and defeated legal challenges that tried to prove the islands’ Egyptian identity.

The island handover shocked many Egyptians, marking a symbolic breach of what had long been a national red line: no relinquishing of land under any circumstances. But it opened the door to further asset transfers and erased long-held taboos.

Gulf investments rapidly expanded, targeting private-sector companies and real estate projects. Yet the volume of investment remained modest compared to the Gulf’s vast sovereign wealth funds, which command trillions of dollars globally.

These funds aggressively seek high-yield investment opportunities across various sectors. While they were keen on expanding their presence in Egypt and acquiring stakes in profitable companies, their ambitions hit a wall: the Egyptian military.

With its dominance over key sectors and refusal to cede influence or withdraw, the army presented a major obstacle—especially with its privileges like free labor, subsidized energy, and tax exemptions. Competing with military-owned firms was commercially unviable.

Everything changed, however, when the 2022 economic crisis erupted and $25 billion in foreign investment fled Egypt’s debt market. Suddenly, the government faced a severe liquidity crunch.

As usual, the regime turned to its Gulf allies for help.

Once again, Sisi’s bet paid off. The Gulf states—eager to avoid Egypt’s collapse—rushed in with about $14 billion in new deposits: $5 billion each from Saudi Arabia and the UAE, and $4 billion from Qatar. Older deposits were also renewed, bringing total Gulf deposits in Egypt to around $28 billion by the end of 2022.

But this time, the funds weren’t grants—they were repayable deposits with interest. No more free handouts.

Shortly after, the Gulf states began acquiring direct stakes in some of Egypt’s top-performing state-owned enterprises. Full financial details were not always disclosed.

Later reports revealed Egypt was losing valuable productive assets. For instance, Abu Dhabi’s sovereign wealth fund recovered nearly half its investment (around $890 million) in just 26 months through profit shares alone, according to an investigation by the “Matsdaqqsh” platform.

When Egypt signed its $3 billion IMF loan in December 2022, Gulf states played a central role by pledging $14 billion in supplemental funding to help close Egypt’s financing gap.

But these funds were tied to a timetable and asset-sale targets. From that point on, privatization ceased to be optional—it became mandatory. Egypt was now required to sell off high-performing companies within a fixed period. If it delayed, IMF loan disbursements would stall.

This weakened Egypt’s negotiating power—especially with the Gulf, which understood the government’s desperation and knew that Cairo’s economic recovery plan hinged on fresh capital inflows.

In January 2023, Saudi Finance Minister Mohammed Al-Jadaan sent a clear message likely aimed at Egypt: his country had changed its aid approach, saying the era of direct grants and unconditional deposits was over. He urged regional partners to pursue economic reforms.

This signaled the new Gulf strategy: aid tied to returns.

Although the Gulf states remained willing to help, they now had prerequisites—seeking dominant shares in strategic sectors and insisting on favorable valuations.

This conditionality stalled many deals, according to media reports. Gulf investors also aligned with IMF demands that Egypt withdraw the military and state entities from the economy, which would open up sectors for private—and Gulf—participation.

As one Saudi economic advisor told reporters on condition of anonymity: “The IMF’s pressure on Egypt to reduce military control creates a big opportunity for Gulf investments to acquire army-owned assets.”

In October 2022, Sisi publicly voiced his frustration with this shift, saying: “Our brothers and friends now feel that the support they’ve given us over the years has made us too dependent on them to solve our problems.”

Throughout 2023, the Gulf states pushed Egypt to devalue the currency, believing the pound was overvalued and that inflated exchange rates hindered acquisitions. As a result, they delayed deals, waiting for better terms.

Still, Egypt resisted—convinced that no one, Gulf states included, would allow it to collapse. Sisi refused to sell military assets or devalue the pound prematurely.

Meanwhile, the Gulf states stood firm, refusing to inject more funds until their demands were met. The IMF loan program stalled. Markets feared Egypt would default. All indicators pointed to the brink.

Then came October 7, 2023—the start of Operation Al-Aqsa Flood in Gaza. Suddenly, regional and European efforts intensified to prevent the collapse of the most populous state in the Eastern Mediterranean.

In response, the UAE signed the largest investment deal in Egypt’s history: $35 billion, including $24 billion for development rights in Ras El-Hekma on the Mediterranean, and $11 billion in public asset acquisitions. Saudi Arabia announced plans to convert its $10 billion in deposits into direct investments.

This enabled the regime to maintain its course—confident that Gulf inflows would continue. Sisi knew each Gulf deal attracted another, as rival states vied for influence.

Following the Ras El-Hekma deal with the UAE, attention shifted to Ras Banas on the Red Sea, which the government has now offered to investors. Reports indicate Saudi Arabia is in talks to acquire it—confirmed by a senior parliamentarian.

Qatar, too, has been linked to potential acquisitions and aims to match Saudi and Emirati investment levels in Egypt. Kuwait, though quieter, still holds about $4 billion in deposits, which it has reluctantly renewed multiple times. Media reports suggest it’s considering converting these into Egyptian investments.

All this means Sisi still holds key cards—chief among them, state assets. Gulf powers are locked in competition over Egypt’s resources, pouring money into a crisis-ridden state that, so far, has avoided financial collapse through privatization and political maneuvering.

Sisi and the IMF: Seeking Refuge in Austerity

With Gulf states backing away from the kind of unconditional support Sisi once relied on, Egypt had to turn elsewhere to fund its ambitious and expensive development agenda. This led to a return to the International Monetary Fund (IMF) after a 26-year hiatus from any major lending program.

In November 2016, Egypt secured a $12 billion loan from the IMF, marking the start of a new and painful chapter—so defining that many Egyptians now divide their lives into two eras: before and after 2016.

The loan came with stringent conditions: currency devaluation, fuel subsidy cuts, and the introduction of a value-added tax (VAT) on nearly all goods and services.

The effects were immediate and deeply felt. Egyptians saw their savings evaporate and their real incomes plummet as inflation soared to record levels. Official figures could not fully convey the suffering inflicted by these reforms, to the extent that even IMF experts acknowledged their harsh impact.

Less than a month after the agreement, Sisi addressed the nation, saying: “We’ve embarked on a difficult journey, one we Egyptians chose to undertake bravely. We knew from the beginning it would require hardship, patience, and sacrifice.”

Over the following years, Sisi continued to defend the IMF-backed reforms, proudly portraying himself as the only leader with the courage to make the tough choices that previous presidents avoided—even though some officials and security agencies opposed the measures due to their expected consequences.

“Before 2016,” Sisi said, “popular backlash against the cost of reform always haunted decision-makers and security services.”

Yet the IMF deal gave Egypt a vote of confidence and opened the door to international capital markets. The country ramped up borrowing in multiple currencies and formats. As a result, Egypt’s external debt quadrupled—from $46 billion in 2014 to roughly $160 billion by the most recent estimates from the central bank.

But the promised “economic reform” never truly arrived. Despite repeated pledges and IMF praise for Egypt’s “commitment and discipline,” the war in Ukraine in February 2022 exposed the fragility of the entire system.

Within weeks of Russia’s invasion, $25 billion in foreign portfolio investments exited Egypt, triggering a severe foreign currency crisis. Once again, Egypt turned to the IMF.

But this time, the Fund raised the stakes.

Negotiations dragged on. In May 2022, during a joint press conference with German Chancellor Olaf Scholz in Berlin, Sisi openly asked Europe to lobby the IMF on Egypt’s behalf.

In anticipation of a new deal, Egypt devalued the pound three times—from 16 to 31 pounds to the dollar. After eight months of talks, it finally secured a $3 billion loan in October 2022, to be disbursed over four years in nine tranches.

But this program came with stricter conditions. Each disbursement would be conditional on performance reviews, making IMF cash contingent on implementation.

Over more than a year, Egypt received just one tranche: $347 million. All others were frozen, pending reforms.

The IMF’s key demands: let the currency float and reduce the state’s footprint in the economy—including businesses owned by the military.

In June 2023, with presidential elections looming, Sisi declared that the exchange rate had become a matter of “national security.” He refused to allow further devaluation, arguing it would harm citizens.

IMF Managing Director Kristalina Georgieva responded quickly: “Using foreign reserves to support the pound is like pouring water into a leaking bucket.”

The stalled program rattled international markets. Credit rating agencies downgraded Egypt. The currency crisis deepened. The black-market dollar rate surged to nearly 70 pounds, while the official rate remained stuck at 31.

Following the $35 billion Ras El-Hekma deal with the UAE, and amid ongoing regional tensions over Gaza, Egypt finally acted. It allowed the pound to drop to around 48 to the dollar.

In March 2024, the IMF revived its program with Egypt, expanding the loan to $8 billion. By May, the IMF board approved a new $820 million disbursement.

But ahead of the fourth program review, which was to determine whether Egypt had met reform benchmarks and could access a $1.3 billion tranche, Sisi made a surprise move.

On October 20, 2024, while speaking at a conference, he publicly called on his government to renegotiate the IMF deal, saying: “If this challenge is going to pressure the public beyond what they can bear, then we must reassess our position with the IMF.”

Days later, on October 23, Prime Minister Mostafa Madbouly confirmed that Egypt would seek to revise the timeline and targets of the agreement.

The next day, IMF chief Georgieva responded diplomatically, saying the Fund was open to revisions—but warned against reversing reforms. “Retreating now,” she said, “would only increase the cost later.”

Sisi’s statements may suggest that he opposes reforms because they burden ordinary Egyptians. But in reality, most of the IMF’s major conditions have already been met.

Since 2022, Egypt has devalued its currency four times—slashing its value from 16 to 48 pounds per dollar. The government raised fuel prices eight times (a cumulative 100% increase) and hiked electricity rates five times. Public transport fares and service fees have also surged.

What Sisi hasn’t done—and what seems to be the real point of tension—is implement structural reforms that would reduce the military’s grip on the economy.

According to the IMF’s three most recent review documents, Egypt has failed to meet conditions for military divestment. No military-owned companies have been sold. The government also dodged the IMF’s demand to eliminate tax and customs exemptions for state-owned entities, including those affiliated with the military.

Other unmet conditions include transparency and governance reforms: timely publication of state enterprise data, procurement records, Central Auditing Agency reports, and budgets for government-owned companies.

Egypt also hasn’t consolidated its budget to include quasi-governmental economic authorities operating without oversight. Nor has it produced a credible plan to reduce off-budget debts and liabilities.

This all suggests that Sisi is fully willing—and even eager—to implement austerity measures that hurt the public. But he either cannot or will not carry out structural reforms that threaten the military’s unaccountable control over state resources.

Yet, economic experts widely agree that such reforms—if enacted—could have transformative effects on Egypt’s economy and improve the lives of its citizens.

Due to the military’s dominance over Egypt’s resources, the regime has been unable to achieve sustainable growth or resolve the country’s core problem: weak productivity, which is directly tied to low wages. Both factors drag Egypt’s economy deeper into crisis.

Instead of confronting these root causes with smart, production-oriented policy, Sisi has doubled down on a debt-driven, real estate-heavy, rentier model—one that sidelines Egypt’s capable private sector in favor of military-controlled infrastructure projects.

This fuels a vicious cycle. The government borrows heavily to fund construction projects that mainly benefit the military. As public liquidity dries up, the country slides into deeper debt.

Sisi is either unwilling or unable to rein in the military or remove it from economic life. Meanwhile, military elites—who oversee sprawling patronage networks—rely on this distorted development model to generate income. They have no intention of giving it up.

This makes any shift toward manufacturing-led development even harder. Egypt’s industrial moment may have already passed. Instead, Sisi and the military have locked the country into a debt-fueled real estate trap.

With the nation’s fiscal health in disrepair, there’s no room left for productive investment. Much of Egypt’s borrowing has gone into flashy but unproductive political projects—designed to impress, distract, or reward military insiders and their contractor allies.

And now, even the new loans being secured serve only to patch old ones, perpetuating a cycle that leaves no visible exit.