In a surprise move on Wednesday evening, December 17, 2025, Israeli Prime Minister Benjamin Netanyahu officially approved a new gas deal with Egypt worth an estimated $35 billion, describing it as “the largest in Israel’s history.”

The announcement followed more than four months of delays, political wrangling, and media back-and-forth between Cairo and Tel Aviv over implementing the agreement giving the deal a significance that extends well beyond its economic dimensions.

NewMed Energy, a partner in the Leviathan gas field, revealed that the agreement included a significant amendment to the previous export deal, adding approximately 4.6 trillion cubic feet of gas in two phases: the first an immediate 20 billion cubic meters, and the second conditional on investments and infrastructure expansions that would allow for the export of an additional 110 billion cubic meters.

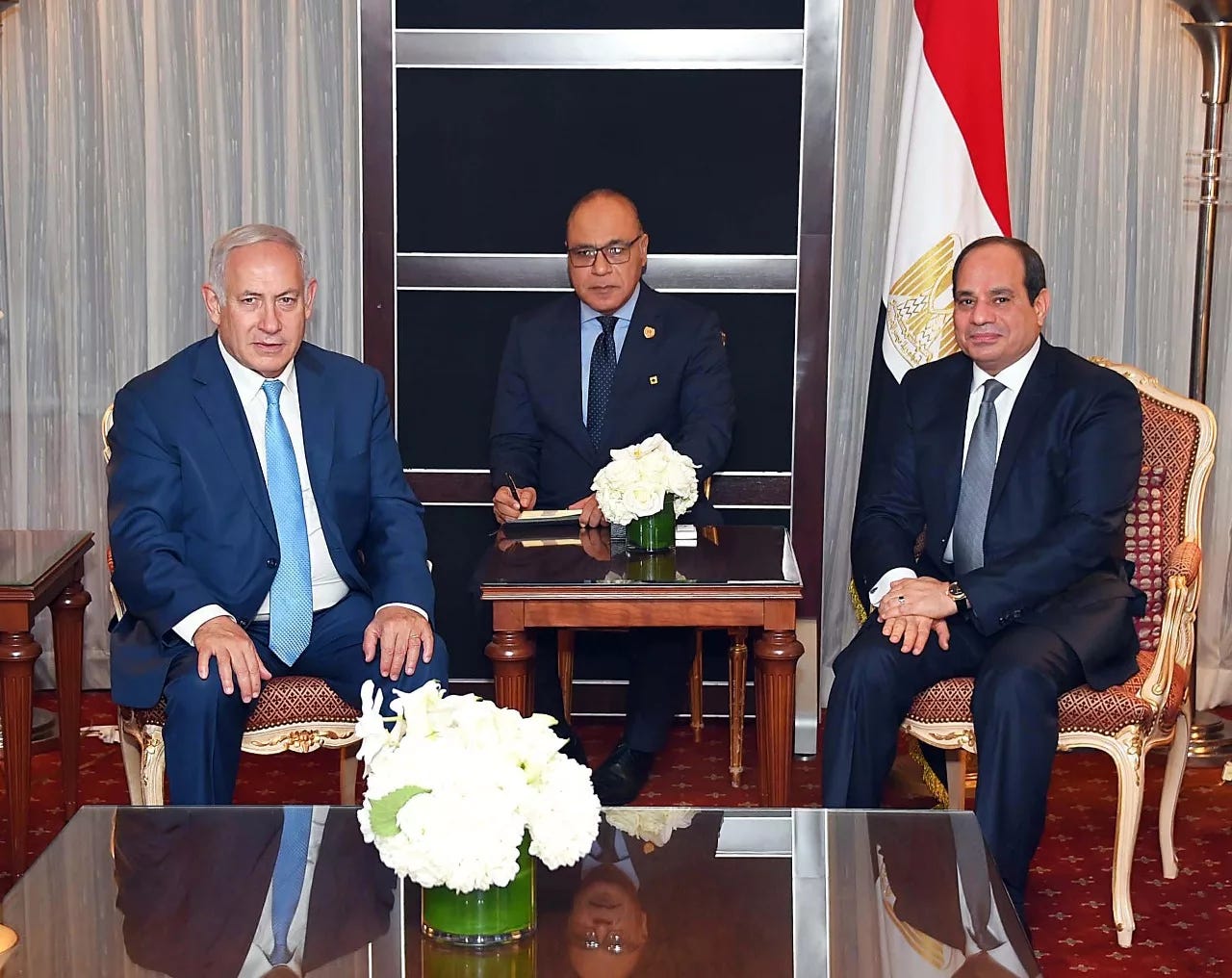

The political weight of the announcement stems from its sensitive timing just ahead of Netanyahu’s expected visit to Washington and talk of a potential meeting with Egyptian President Abdel Fattah el-Sisi alongside renewed discussions about the second phase of the Gaza agreement.

This raises the question: is the deal merely a long-term energy contract, or is it a political instrument for reshaping regional arrangements amid an intensely complex moment?

Israel Announces, Cairo Remains Silent

Before delving into the details and implications of the deal, it is striking that Israel first announced it unilaterally in August right in the midst of its war of annihilation against Gaza while Egypt remained conspicuously silent.

This silence, particularly in its timing and implications, raised numerous questions. The announcement was not leaked or attributed to a secondary source; it was a deliberate political message from Tel Aviv.

Not long after, Israel backtracked, again unilaterally suspending the deal and halting its implementation. Although this delay was announced directly by Netanyahu, Egypt responded only with a brief statement from the head of the State Information Service, without offering any explanatory narrative or political initiative to rebalance the scene leaving the impression that the initiative remained firmly in Israel’s hands.

The same scenario is now repeating: while Cairo explored alternative options to address Israeli foot-dragging, Netanyahu emerged to officially approve the deal again without any Egyptian response or comment.

This has dealt a blow to the image of Egypt as a key regional mediator long seen as an influential player in regional affairs now appearing more like a constrained actor, bound by the tempo and terms set by the other side, rather than one capable of asserting its own timing and agency.

A Pattern of Delay

Since it first emerged, the gas deal has followed a convoluted trajectory marked by Israeli stalling and political maneuvering. A chronological review clearly reveals Tel Aviv’s use of the agreement as a multi-purpose pressure card.

It began in June, when Israel halted production at its offshore gas fields, citing security concerns tied to rising regional tensions amid strikes on Iran. This led to a complete suspension of gas supplies to Egypt despite the 2018 agreement between the two countries.

Deliveries resumed about two weeks later, underscoring the fragility of Israeli commitments and its readiness to suspend them at will.

Then in August 2025, at the height of its war on Gaza and amid growing grassroots and official boycotts of the occupation, Israel unilaterally announced a massive agreement to export about 130 billion cubic meters of gas to Egypt through 2040, worth an estimated $35 billion. Israeli Energy Minister Eli Cohen described it as “the largest gas deal in Israel’s history.”

The announcement sparked widespread anger across Egyptian and Arab public opinion, viewed by many as a political betrayal at a time when Palestinians were facing open extermination amid official Arab silence and impotence.

In response, the Egyptian government sought to contain the outrage, framing the deal as an extension of the 2018 agreement in an attempt to de-politicize it and reduce the backlash.

September 2025 brought renewed escalation, when Netanyahu abruptly announced a review of the deal, citing what he called “Egyptian military movements” in Sinai near the border, which he deemed a violation of the peace treaty’s security annex.

This time, Egypt responded more directly through the head of the State Information Service, Diaa Rashwan, who warned that undermining the agreement would have severe economic consequences for Israel, as well as unpredictable political repercussions.

He stressed that Egypt was not dependent on a single energy source and had alternative plans, including reactivating channels with Cyprus and other nations.

In November, Israel once again unilaterally announced a suspension of the deal’s implementation, citing disputes over domestic pricing mechanisms. The Israeli Energy Ministry stated it would not move forward without ensuring a fair price for its domestic market and full satisfaction of local demand effectively halting any discussion of binding commitments and reinforcing the perception of the deal as a tool of political extortion rather than a stable economic agreement.

Why Approve the Deal Now?

As with previous announcements, Israel moved unilaterally through Netanyahu, abruptly ending a long phase of delay and opening the door to questions about the true motivations behind the sudden approval.

Upon closer inspection, four primary drivers appear to have converged at this particular moment:

First, mounting US pressure, especially from the Trump administration, which grew increasingly frustrated with Israel’s stalling. This frustration culminated in the unprecedented cancellation of a planned visit by US Energy Secretary Chris Wright to Israel—a clear message of dissatisfaction, particularly over the lack of transparency around domestic pricing mechanisms and Netanyahu’s refusal to finalize the deal.

Second, Israel succeeded in using the agreement as a political leverage tool against Cairo and other Arab capitals. It effectively neutralized Egypt’s stance on the Gaza war, confining Cairo’s role to that of a neutral mediator, avoiding deeper engagement with developments in Gaza.

Third, Netanyahu’s government likely sought to court Egypt ahead of the post-war phase in Gaza, nudging Cairo toward positions that align—if not fully converge—with the Israeli narrative.

Fourth, and perhaps most urgent, is Israel’s need for financial resources to offset the massive economic toll of its two-year war in Gaza in terms of growth, investment, and market confidence.

Together, these factors formed the real incentive behind Netanyahu’s shift from delay to approval not merely as an economic choice, but as a political and financial necessity at a critical juncture.

Washington’s Approach to the Deal

The Trump administration’s approach is rooted in hard-nosed pragmatism, placing interests above even the closest alliances. Based on this logic, Washington has not hesitated to clash with Tel Aviv when its actions threaten US strategic goals.

For the US and Europe, Eastern Mediterranean gas is a strategic asset for diversifying energy sources and enhancing geopolitical influence in a contested region. Thus, the disruption of the Egypt-Israel gas deal was viewed as a direct threat to the India–Middle East–Europe Corridor (IMEC) Washington’s flagship alternative to China’s Belt and Road Initiative.

European observers warn that instability in this project risks undermining investor confidence and threatens one of the most significant geopolitical ventures Washington is backing in the Middle East.

Therefore, Israel’s repeated threats to suspend or renegotiate the deal are seen less as genuine intentions to scuttle the agreement, and more as pressure tactics targeting Cairo, especially in response to its stance on the displacement issue.

Amid these tensions, the US played the role of stabilizer, pushing forward a separate $4 billion US gas deal with Egypt offering a temporary fix to protect the strategic agreement and ensure both Egypt and Israel remain aligned with US regional priorities.

All Gains for Israel, More Burdens for Egypt

Israel emerged as the clear beneficiary of the deal, viewing it as a key financial lifeline to offset the war’s heavy toll.

At a deeper level, the agreement represents a strategic move to create a “new regional legitimacy,” positioning Israel as a central player in the Eastern Mediterranean energy system with Egypt as its crucial gateway to international markets.

Despite Egypt’s potential short-term benefits, the deal imposes serious burdens. Amendments removed key protective clauses, such as Cairo’s right to reduce imports if Brent crude falls below $50 per barrel. The deal also includes a “take or pay” clause, obligating Egypt to pay in full regardless of whether it receives the gas.

What’s Next?

Reducing the deal to a purely economic transaction would be a mistake. The developments show that energy in this case is not just business it’s a political instrument par excellence.

Despite increasingly intertwined economic and political ties between Cairo and Tel Aviv in recent years, the Israeli government hasn’t hesitated to use the agreement as a strategic card pushing Egypt toward greater flexibility on the issue of Gaza’s displaced population, a red line for Cairo due to its implications for national security.

Additionally, Tel Aviv has raised renewed concerns about Egypt’s military deployments in Sinai, despite its public rhetoric about security coordination.

Thus, the deal’s approval can be seen as an effort to repair recent cracks in Egypt-Israel relations and open the door to renewed understandings potentially through meetings between Presidents el-Sisi and Netanyahu in Washington or Cairo.

While some Egyptian analysts dismiss the likelihood of such a meeting, history shows that in politics, little is impossible especially with Tel Aviv eager to woo Cairo into adopting post-war Gaza reconstruction and governance frameworks more aligned with Israeli objectives.

The key question remains: How far will Israel go in achieving its full set of strategic goals through this deal?