Since ancient times, the Egyptian economy has been rent‑based, drawing most of its revenues from natural‑resource rents resources that played no role in the country’s initial creation rather than relying on productive sectors such as industry, agriculture, or services.

It became evident by the mid‑1970s that rent‑based income was the main engine of Egypt’s economy, deriving from oil revenues and earnings from the Suez Canal. Economists also consider foreign aid and remittances from Egyptians working abroad as rent-derived income, since these do not stem from domestic productive activity, and often do not contribute to building internal production instead, they arrive like a windfall from the sky.

According to Dr. Galal Amin (American University in Cairo), when Egypt’s economy grows, it does so thanks to rent incomes. And when its growth falters, it is because those resources have dried up. If one excludes community-based or volatile resources and focuses only on state‑managed ones under governmental control, one finds that even though Egypt is not richly endowed with resources compared to its population size or neighboring countries that does not mean it is resource-poor.

Rather, the path the state followed over recent decades has been marked by high levels of waste and corruption, as institutional and personal elites seized control over these resources and allotted themselves the major shares of rent.

This dynamic has clearly been reflected in Egypt’s economy, plunging it into an unending cycle of chronic crises leading to worsening living conditions for the majority of the population, the absence of economic justice, and sharp increases in social inequality.

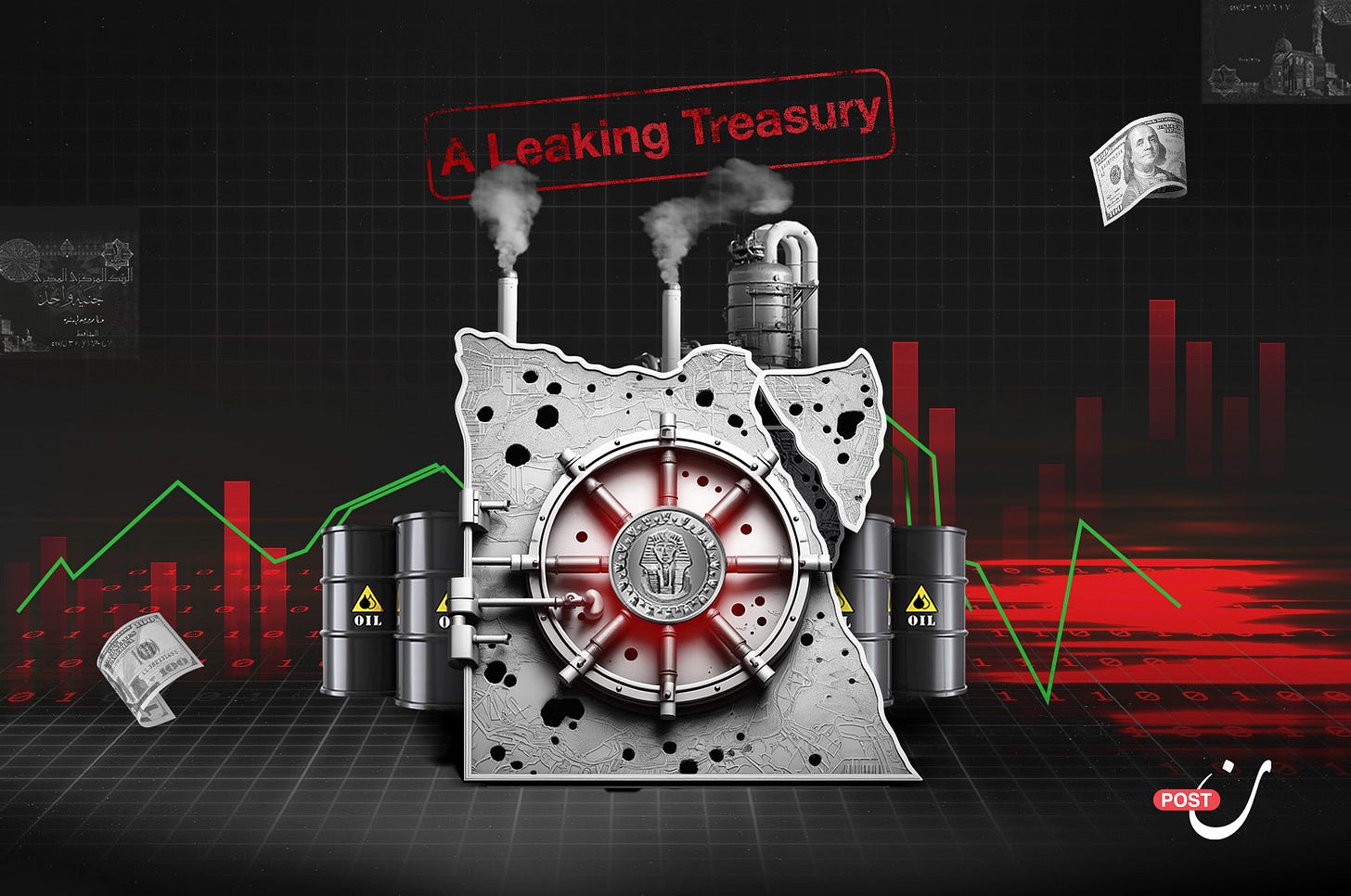

In this piece part of the “Leaky Treasury” dossier we highlight how successive regimes handled the resources Egypt possessed, with a focus on its oil and natural‑gas wealth.

We trace how inept management drained these resources or inflicted huge losses, depriving the Egyptian treasury of massive potential revenue, and, worst of all, forcing the state into energy crises and turning it into a net energy importer.

Oil: A Continuous Depletion of Reserves

Egypt was among the pioneering countries in the region to discover oil, back in 1908. Foreign interests dominated its resources for decades, until the state began nationalizing them in 1948 culminating in full nationalization by 1964.

In the third stage beginning in 1974 under President Anwar Sadat the door was reopened to foreign oil companies investing in the sector. This marked a major shift: oil became one of Egypt’s key economic activities, playing a pivotal role in Egypt’s social and economic development, a role that persists to this day.

After the 1973 War and the subsequent jump in global oil prices, Egypt relied on oil exports to generate revenue that could shield it from budget deficits. During the 1970s and 1980s, the government signed numerous exploration and concession agreements in both the Western Desert and the Nile Delta, triggering a surge in exploration efforts which reflected in increased oil reserves for Egypt.

Instead of using that newfound wealth to develop non‑rent sectors exporting manufactured goods, services, or attracting investment successive governments continued to depend on oil‑derived revenue, which at the time accounted for a substantial portion of general revenues.

They found it difficult to abandon it even when oil prices fell in the early 1990s; instead, they boosted production to compensate for the price collapse, which dropped to about $12 per barrel. By 1993 Egypt reached its production peak: 912,000 barrels per day a level the sector has never again achieved.

At that time, however, production rights seldom belonged solely to the Egyptian government. Foreign oil companies holding extraction rights received approximately 50 percent of output and could dispose of it freely.

The government itself could purchase no more than 20 percent, according to the terms of an agreement between Cairo and the U.S.-based Pan American Petroleum Corporation a fact underscored by researcher Abdel‑Hamid Makawi in his chapter “The Political Economy of Oil in Egypt” in the book “Owners of Egypt: The Rise of Egyptian Capitalism Part II.”

After the ouster of President Hosni Mubarak, signs of corruption in the oil sector became clearer. Contract terms had been skewed in favor of foreign companies that held concessions. Yet, production continued at high levels even as global prices remained weak a combination that eventually proved unsustainable.

By the late 1990s, production had dropped to around 729,000 barrels per day; in the early 2000s it fell below 700,000 in most years. What once had been said to supply nearly half of national consumption in the 1990s reversed by 2006, Egypt became a net oil importer.

Estimates suggest that more than 80% of Egypt’s confirmed oil reserves had been depleted. By 2021, according to the energy‑data platform, Egypt’s reserves stood at roughly 3.3 billion barrels down from 4.5 billion barrels in 2010.

As of January 2024, Egypt’s oil production hovers around 559,000 barrels per day. In parallel, consumption has surged, widening the gap between output and demand, forcing the government to import roughly 100 million barrels annually.

In 2022 alone, the cost of those imports reached an estimated $12 billion draining foreign‑currency reserves just when the economy was already facing a foreign‑exchange crisis.

If current production rates continue, and with reserves already diminished, Egypt’s oil output could be effectively exhausted in as little as 14 to 16 years a result of mismanagement and reckless depletion, compounded by the fact that the extraction was done with minimal regard for securing developmental returns.

The nation’s present and future generations were deprived of their fair share in this national wealth, left to bear the debt of prolonged energy scarcity.

Natural Gas: Unjustified Losses

After Mubarak stepped down in 2011, one major obstacle to unearthing decades of corruption in gas‑export contracts was removed. What emerged was a series of deals that sold gas at rock‑bottom prices above all contracts with Israel, Jordan, and Spain.

For instance, in 2001, the government-run East Mediterranean Gas Company contracted with the Israeli firm Electric Corp to supply 7 billion cubic meters of natural gas annually for 15 years at prices ranging between 75 and 125 cents per million British thermal units (MMBtu).

By 2008, public outrage over the agreement prompted legal challenges, exposing grossly unfair terms that stripped Egypt of vast economic gains, while granting Israel privileges at bargain prices locked in with no provision for adjustment to rising global market rates.

Newspaper documents published by Al‑Masry Al‑Youm show that in 2004, businessman Hussein Salem wrote to the then‑Minister of Petroleum requesting the minimum price be halved to $0.75. The prime minister approved this cut on the same day.

Consequently, Egypt lost major economic opportunities: while Syria and Lebanon received gas at around $5.50 per MMBtu, Egypt sold the same gas to Israel at just $0.75. The difference was staggering. Two rulings issued by the State Council of Egypt in 2008 and 2010 ordered a halt to exports to Israel. But the ministry appealed, and exports resumed. Later adjustments raised the price to $3 per MMBtu still far below market rates.

Following the 2011 revolution, the government canceled the Israel gas deal in 2012. The result: Israel took Egypt to international arbitration and won compensation of $500 million in 2019.

Meanwhile, Egypt signed two agreements with Jordan (in 2003 and 2007) to supply 77 billion cubic feet at $1.27 per MMBtu, and another 32 billion cubic feet at $3.06 per MMBtu. Analytical studies later estimated that Egypt lost out on roughly $3.8 billion in potential revenue between 2005 and 2010 gains that instead benefited private firms and the Jordanian state, not the Egyptian treasury.

Beyond dealings with Israel and Jordan, Egypt liquefied gas for European export parcels at its Dumyat LNG Plant and Idku LNG Plant. A 2000 secret agreement between petroleum companies and the Spanish firm Union Fenosa revealed during the high-profile “Gas Export Contracts Case (No. 41)” showed that 64% of the gas exported from Dumyat was sent to Spain under heavily subsidized pricing. The scandal led to a trial of Hussein Salem and the former petroleum minister Sameh Fahmi, both of whom were sentenced to 15 years in prison.

Comparative analyses of actual revenues versus market‑adjusted rates during 2005–2010 point to a shortfall exceeding $6 billion lost revenues that rightly belonged to Egypt’s public coffers.

And the story doesn’t end there. After 2015’s giant discovery of the Zohr Gas Field, boasting an estimated 30 trillion cubic feet of gas reserves, the government declared self‑sufficiency by 2018 signaling Egypt’s ambition to become a regional energy hub. Officials even envisioned importing Mediterranean gas, liquefying it in Egyptian facilities, then re‑exporting it to Europe: a triumphant “goal achieved” narrative broadcast widely by the presidency.

But within a few years, the situation reversed dramatically. Production at Zohr began to decline; Egypt was forced to import Israeli gas to meet domestic needs not for re-export, as originally planned.

The government also procured additional shipments of liquefied natural gas (LNG) during recent months to keep power plants running, turning Egypt from one of the world’s top exporters of gas into a net energy importer a dramatic reversal underscoring how poor resource management can undo years of supposed progress.

At its peak in 2022, Zohr produced about 2.6 billion cubic feet per day. Riding a wave of demand driven by the global energy crisis and Europe’s ban on Russian oil, Egypt ramped up exports liquefied volumes jumped by 171% compared to the previous year, reaching 7.4 million tons. Revenues soared to roughly $8.4 billion, providing temporary relief to foreign‑exchange shortages while more than half a billion citizens suffered from worsening economic pressures.

Yet in 2023 production declined sharply. Anticipated gas exports, which were supposed to earn Egypt up to $1 billion per month, collapsed. The decline triggered widespread electricity blackouts during summer months, as power plants ran short of fuel. The government imposed rolling electricity cuts initially one hour per day, then two-to-three hours per day when the shortage deepened with the onset of summer.

By early 2024, output from Zohr had dropped to its lowest since the field’s discovery nearly nine years earlier. Simultaneously, Israel cut back deliveries by 26% during peak summer demand, intensifying load shedding in Egypt and forcing the government to drastically restrict gas allocation to industries like cement and fertilizer deepening pressure on strategic sectors.

To prevent total collapse, Egypt began purchasing additional LNG shipments a costly move, logistically burdened and externalizing what should have been domestic supply. This step transforms the country’s relationship with energy from self-reliant producer to dependent importer, draining what little foreign currency remained.

Tracing the history of how Egypt has managed its oil and gas from waste and corruption to poor planning and short‑term exploitation reveals that the root of the present energy crisis lies in decades of mismanagement. This collapse did not stem from scarcity of resources, but from exploitation, bad governance, and lack of transparency.

Conclusion

The core of any sound economic policy lies in efficient allocation of resources and in fostering social and economic justice. Instead, Egypt’s natural‑resource mismanagement has produced results starkly misaligned with the scale of its wealth.

The heavy price has always been borne by the poor and middle classes the vast majority of citizens while a narrow elite cornered the benefits. This violates constitutional guarantees that natural‑resource wealth belongs to all citizens and should be shared equitably.

Achieving real equity requires deep systemic change: transparent public disclosure of all state budgets and contracts, full publication of deals made by state‑owned entities, and open access to data on obligations, revenues, and expenditures so that citizens can oversee and hold authorities accountable. Only then can the misuse of national wealth be stopped, and Egyptians’ right to their shared resources secured.